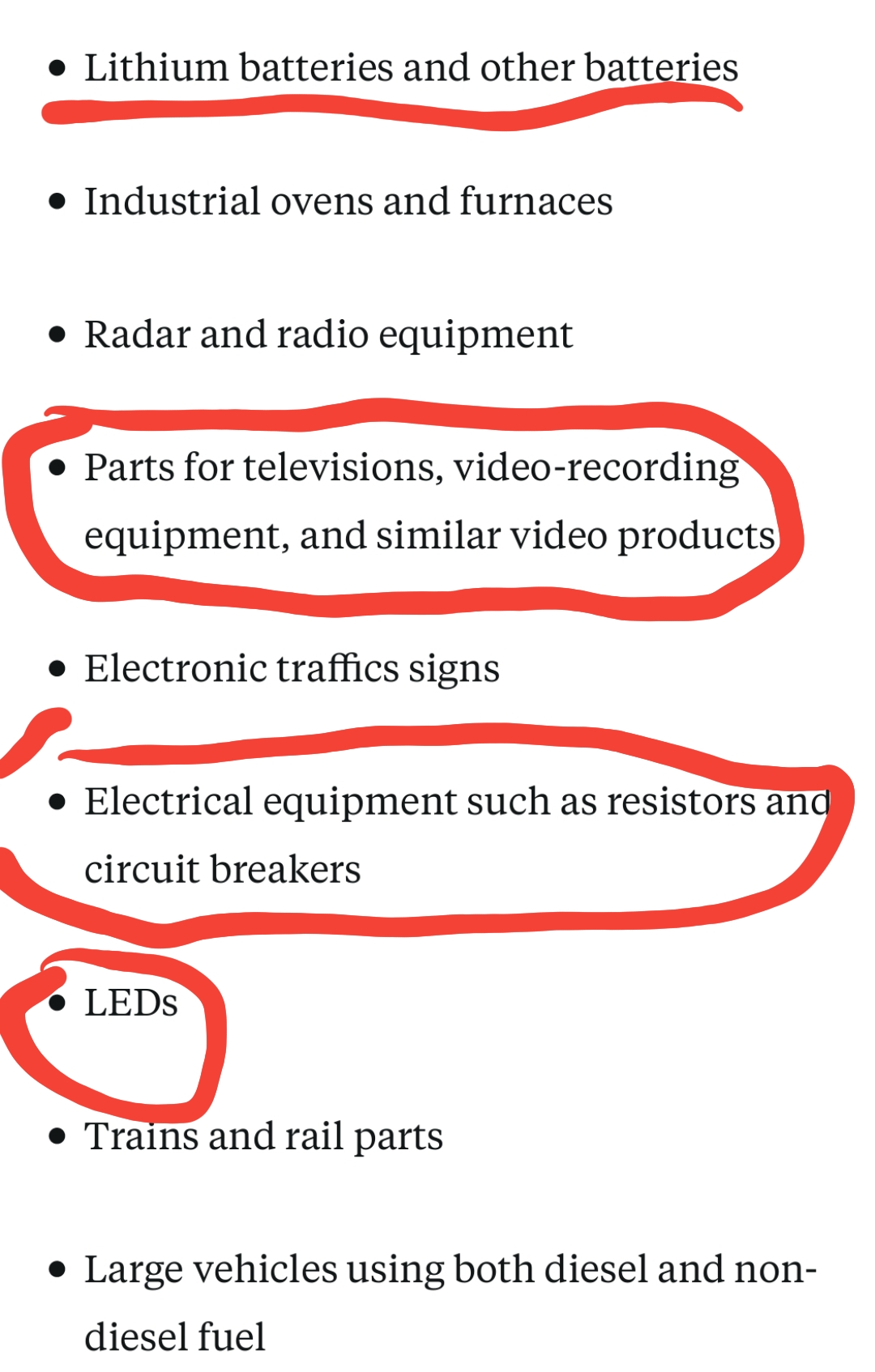

Our "president" is hell-bent on destroying the US and our relationships with allies around the world. Part of his scheme involves starting a trade war with China, and imposing a 25% traffic on goods imported from China. Part of the list is shown in the picture below, but the list includes LEDs, resistors and "tv components." I suspect the detailed list includes most of the stuff we buy on ebay (components, modules, kits, etc.) and circuit boards fabricated and/or assembled in China.

This news only came out yesterday, so I doubt anybody has seen any impact yet. I'd appreciate hearing anybody's experiences with this, including:

Does this delay shipping of goods, duty or not?

Are bare circuit boards subject to this duty? Assembled boards?

What items have you received from China have required duty?

What items have you received from China that didn't require duty?

Is the duty applied consistently?

How is the duty collected by DHL, UPS, FEDEX?

How is the dutt collected by USPS?

This tariff started a few days after I committed to a thousand dollar circuit board azsembly project in China. I'm expecting a big duty bill which my client won't be happy about, and delays in shipments as this gets sorted out.

I is/was also planning on getting some parts from ebay. I really don't want to pay a 25% surcharge on my parts.

Thanks in advance for sharing any experiences you have with this.

This news only came out yesterday, so I doubt anybody has seen any impact yet. I'd appreciate hearing anybody's experiences with this, including:

Does this delay shipping of goods, duty or not?

Are bare circuit boards subject to this duty? Assembled boards?

What items have you received from China have required duty?

What items have you received from China that didn't require duty?

Is the duty applied consistently?

How is the duty collected by DHL, UPS, FEDEX?

How is the dutt collected by USPS?

This tariff started a few days after I committed to a thousand dollar circuit board azsembly project in China. I'm expecting a big duty bill which my client won't be happy about, and delays in shipments as this gets sorted out.

I is/was also planning on getting some parts from ebay. I really don't want to pay a 25% surcharge on my parts.

Thanks in advance for sharing any experiences you have with this.